The 10th edition of the Kenya Bankers Association Annual

Banking Research Conference kicked off on Wednesday with papers that explored opportunities to

enhance the banking industry’s role in supporting economic recovery in light of the COVID19 disruption. Research papers presented during the opening session this focused

on the impact of the pandemic on risk assessment, highlighting opportunities towards

supporting further credit growth in the wake of the pandemic.

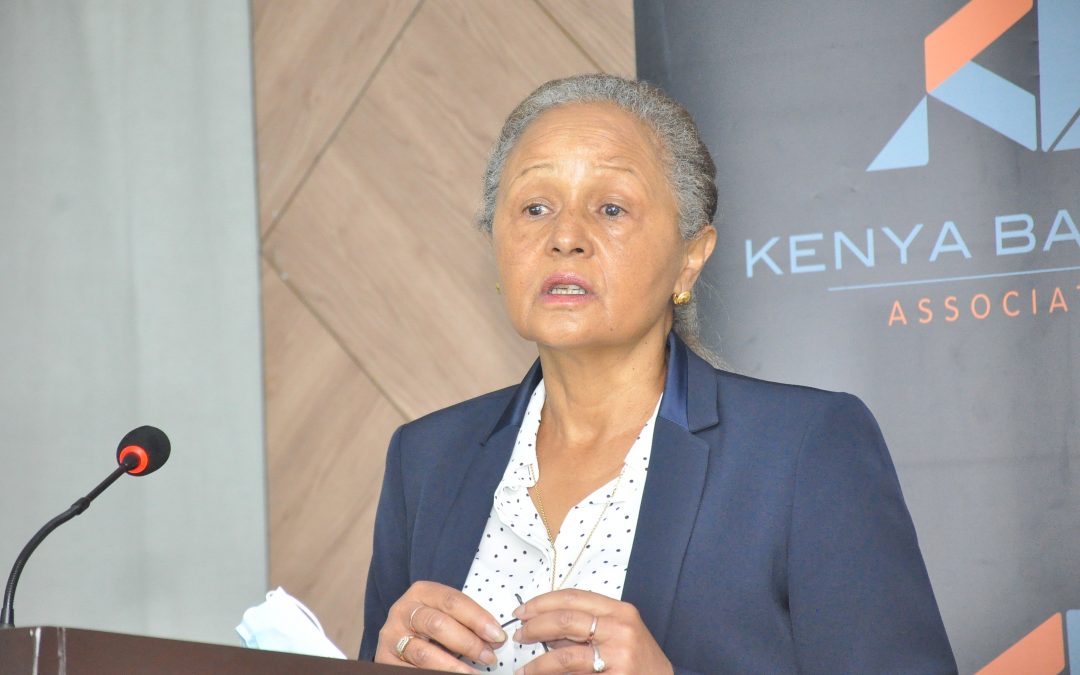

While officiating the conference’s opening ceremony, Central Bank of Kenya (CBK) Deputy

Governor, Sheila M’Mbijjewe said the COVID-19 pandemic has amplified opportunities

and risks, noting that resilience would be important in navigating through the health crisis.

‘Banks have been critical in bringing Kenya to its current state of stability,’ said Mrs.

M’Mbijjewe, adding that economic arguments should be answered through clear

economic policies.

Kenya Bankers Association Governing Council Chairman, John Gachora observed that

the pandemic has extensively depressed the economy, noting that facilitating an

understanding of the financial environment through research has become a necessity

considering the dynamics of the Kenyan market and global disruptions caused by the

COVID-19 pandemic.

‘’These dynamics are seen to have a bearing at both the policy and operational fronts, and

at the broader economic environment under which banks, just like other businesses,

operate. It is in recognition of these dynamics that the banking industry, through the Kenya

Bankers Association, has endeavoured to ground its understanding of the current and

emerging developments through research,’’ he said.

On his part, the KBA Chief Executive Dr. Habil Olaka expressed optimism that the Kenyan

banking industry’s resilience will play a critical role in supporting a strong and sustainable

economic recovery in the year 2021. ‘’How the industry navigates the potential trade-offs of

ensuring a stable system and supporting economic recovery is a tight balancing act, that

would be informed partly by the focus of some of the papers lined up for presentation in

this conference,’’ he added.

This year’s conference marks the 10th anniversary of the forum that brings together

researchers, financial sector players, policymakers, and academia. This year’s discussions

will further shed light on risks and risks assessment in the banking sector in the wake of

COVID-19 and the effect of the pandemic on the sector’s asset portfolios and innovations.

Institutions which will participate in the conference include the KBA Centre for Research on

Financial Markets and Policy, Financial Sector Deepening Africa (FSDA), Strathmore

University, Embu University, NCBA Bank and the Central Bank of Kenya.